The 6 Advanced E-commerce Reports To Build a $100M Brand

If you’re running an e-commerce brand doing $5M, $20M, or $80M, I’m going to tell you something your Facebook ads agency won't: Your ROAS is lying to you.

It’s the great industry secret. We’ve all been conditioned to stare at the Shopify dashboard, see that "Total Revenue" line go up, and feel like geniuses. But behind the scenes? Your margins are getting punched in the throat by rising CAC, your inventory is gathering dust like a 1980s workout VHS, and you’re probably sending 20% discount codes to people who would have paid full price.

If you want to move from "scaling by luck" to "growing by design," you need to stop looking at vanity metrics and start looking at these six reports. They aren’t sexy, but they are the difference between a business that’s a cash-flow machine and one that’s just a very expensive hobby.

1. The View to Buy Report (The "Leaky Bucket" Detector)

Most people stare at their site-wide conversion rate. That’s like checking the average temperature of the entire Atlantic Ocean to decide if you should wear a wetsuit in Miami. It’s useless.

The View to Buy Report is the antidote. It zooms in on your Product Detail Pages (PDPs) to see who is actually interested versus who is actually buying.

$$View to Buy Rate = \frac{Unique Purchases}{Unique Product Views}$$

Look, if you have a product getting 10,000 hits a month but only 50 people are buying it, your marketing team isn't the problem. The page is. You’re paying for a crowd to enter the store, but when they get to the shelf, something is turning them off—maybe the photos look like they were taken on a flip phone, or the "Add to Cart" button is playing hide-and-seek.

As we’ve argued before, The View to Buy Report is the one report that will save your BFCM week because it tells you exactly where your ad spend is being set on fire. If a product has a low View to Buy rate, stop throwing money at it. Fix the page first, then turn the tap back on.

2. Product Contribution Margin (The "True Profit" Report)

If I could have any superpower, it wouldn’t be flying; it would be omniscience. I want to see the hidden mechanics of why a business actually works. In e-commerce, that "ultimate truth" is product-level profitability.

Most people look at a "Bestseller" and see a hero. But until you break it down, you're just looking at a reflection of reality. You need a report that follows the money out as carefully as it follows the money in.

$$Contribution Margin = Revenue - (COGS + Shipping + Variable Ad Spend)$$

We’ve built systems that pull daily data from UPS, Shipstation, Meta, and Google to find this number. But you should start with a simple, ugly, manual spreadsheet. When you see your "Hero SKUs" side-by-side with their real costs, it changes you. You’ll find that some of your high-volume items are quietly burning cash because the return rates are nightmares or the shipping eats the margin alive.

Stop being a "revenue at any cost" junkie. When you find the products that have a high Gross Margin per Visitor, those are the ones that deserve the paid support. The rest? They’re just "Profit Vampires" that belong in the footer.

3. Merchandising & Inventory Health

Inventory is just cash that’s sitting in a warehouse, unable to buy you a margarita. This report bridges the gap between the marketing team (who wants to sell everything) and the ops team (who has to deal with the physical reality of the warehouse).

You need to track your Weeks of Supply (WOS). Running ads for a product that only has 2 weeks of supply left is just a great way to pay money to frustrate your customers. It’s a fireable offense.

On the flip side, if you have 40 weeks of supply sitting there, it's time to get aggressive. Bundle it, discount it, or give it away as a "gift with purchase" to move the needle. Clear the shelf so you can reinvest that cash into something that actually turns over.

4. Product "Gateway" & Affinity

Not all customers are created equal. Some buy a $10 accessory once and never come back. Others buy a specific $80 jacket and end up spending $2,000 over the next three years.

The Gateway Report identifies which specific products act as the best entry points for high-LTV (Lifetime Value) customers.

The "unsaid" truth here? Your most popular first-purchase product might be a "one-and-done" item. It brings in "tourists," not "citizens." You want to find the products that lead to the second purchase. Use those Gateway products for your Top-of-Funnel ads. Even if the initial cost to acquire the customer is higher, the long-term math wins every time.

5. Customer Discount Sensitivity Matrix

Stop being a "coupon crack" dealer. If you send a "20% Off Everything" blast to your entire email list, you are effectively handing cash to people who were perfectly willing to pay full price.

This report segments your audience by their psychological need for a discount. You’ve got:

The Loyalists: They love the brand and buy regardless of price. Stop discounting for them. Give them "Early Access" or "VIP Status" (which costs you $0).

The Bargain Hunters: They only show up when the "SALE" sign is in the window.

Treat your margin like the finite resource it is. Save the deep discounts for the people you’re trying to reactivate or to move that stagnant inventory we talked about in the inventory report.

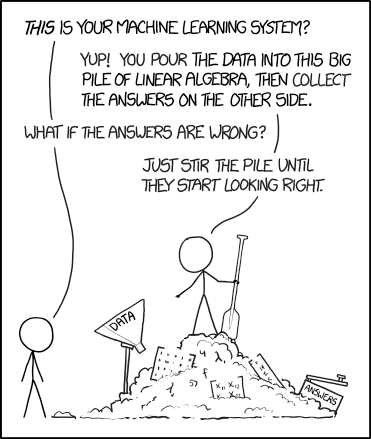

This is what most people think Predictive Revenue looks like. We just stir the pile until the numbers start looking like a $100M brand. Credti: XKCD

6. User Cohort with Predictive Revenue

This is where we stop looking in the rearview mirror. Most founders scale until they run out of cash because they don't understand their payback period. They see a low ROAS today and panic, not realizing that specific cohort of customers will be worth 4x that in six months.

Using BTYD (Buy 'Til You Die) modeling, you can project the future revenue of your existing customer base without spending another dime on acquisition. This is the "CFO’s Crystal Ball."

If you know a customer acquired today for $50 will be worth $200 by Christmas, you can stop sweating the daily fluctuations of the Meta algorithm and start outspending your competitors. It’s about scaling with confidence instead of crossing your fingers.

Using this report gives you additional budget to find more new customers, because you can rely on existing ones to come back every month.

Go Build These Reports

If you’re stuck between $3M and $100M, you can’t "hustle" your way to the next level. You can’t just copy what your competitors are doing because, frankly, they’re probably guessing, too.

Most agencies will give you a PDF of "best practices" and some "button color tests." We’d rather look at your View to Buy report and tell you why your site is failing your media spend. It’s not always the polite conversation you’ll get at a corporate board meeting, but it’s the one that grows your revenue per visitor.

Ready to see what's actually happening under the hood? Reach out, we have products to build these reports for you, or guide your team.

Check out what else we’ve been writing about or send Justin a message on LinkedIn.

Want more?

Make your job easier, let Mobile1st Grow RPV for you

At Mobile1st, we help e-commerce brands grow revenue per visitor.

We do it by combining customer-first research with testing and experimentation that cuts through the noise of dashboards and opinions. Our team uncovers what really drives purchase decisions, then runs experiments to prove impact — so you can stop guessing and start scaling

Want help? Reach out.

The Future of E-Commerce with Andrew Mosko

Listen to the latest episode of season two of Checkin to Checkout.